PAN Frauds: How to prevent one and available legal remedies.

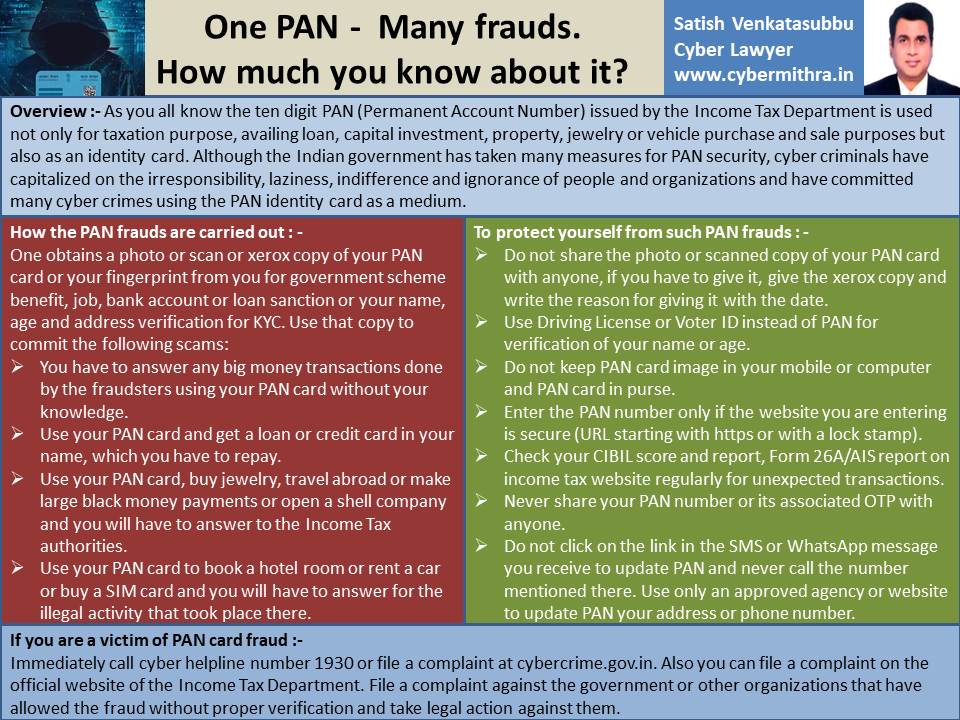

PAN frauds are on the rise nowadays, As you all know the ten digit PAN (Permanent Account Number) issued by the Income Tax Department is used not only for taxation purpose, availing loan, capital investment, property, jewelry or vehicle purchase and sale purposes but also as an identity card. Although the Indian government has taken many measures for PAN security, cyber criminals have capitalized on the irresponsibility, laziness, indifference and ignorance of people and organizations and have committed many cyber crimes using the PAN identity card as a medium.

How the PAN card is used for frauds :-

One obtains a photo or scan or xerox copy of your PAN card or your fingerprint from you for government scheme benefit, job, bank account or loan sanction or your name, age and address verification for KYC. Use that copy to commit the following scams:

- You have to answer any big money transactions done by the fraudsters using your PAN card without your knowledge.

- Use your PAN card and get a loan or credit card in your name, which you have to repay.

- Use your PAN card, buy jewelry, travel abroad or make large black money payments or open a shell company and you will have to answer to the Income Tax authorities.

- Use your PAN card to book a hotel room or rent a car or buy a SIM card and you will have to answer for the illegal activity that took place there.

How you can protect yourself from PAN fraud :-

- Do not share the photo or scanned copy of your PAN card with anyone, if you have to give it, give the xerox copy and write the reason for giving it with the date.

- Use Driving License or Voter ID instead of PAN for verification of your name or age.

- Do not keep PAN card image in your mobile or computer and PAN card in purse.

- Enter the PAN number only if the website you are entering is secure (URL starting with https or with a lock stamp).

- Check your CIBIL score and report, Form 26A and AIS report on income tax website regularly for any unexpected transactions.

- Never share your PAN number or its associated OTP with anyone.

- Do not click on the link in the SMS or WhatsApp message you receive to update PAN and never call the number mentioned there. Use only an approved agency or website to update PAN your address or phone number.

If you have been scammed of PAN frauds :-

Immediately call cyber helpline number 1930 or file a complaint at cybercrime.gov.in. Also you can file a complaint on the official website of the Income Tax Department (steps given below). File a complaint against the government or other organizations that have allowed the fraud without proper verification and take legal action against them.

Steps to Report Misuse of PAN Card with Income Tax Department :-

The Income-tax department under the Indian Government has developed an electronic website to file PAN Grievances through Aayakar Sampark Kendra (ASK). Therefore, you can follow the steps discussed below to report a misuse after you spot one in your PAN.

- Step 1: Visit the official portal of TIN NSDL. Search for the customer care section on the Home page.

- Step 2: Select the “Customer care” tab. It will open a drop-down menu.

- Step 3: Click on “Complaints/Queries” from the drop-down list. It will open a complaint form.

- Step 4: Fill this form with your accurate data, describing the nature of the complaint. Enter the Captcha code and click on “Submit”.

Legal remedies available to the victim of PAN frauds:-

One can register a criminal case in cyber police station under

- section 419 (punishment for cheating by impersonation) and 420 (cheating and dishonestly inducing delivery of property) of Indian Penal Code(IPC).

- section 43 (Penalty and compensation for damage to computer, computer system, etc), section 66 (punishment for computer related offences – a person committing data theft, transmitting virus into a system, destroying data, hacking, or denying access to the computer or network to an authorized person is imprisoned for a maximum of 3 years or a fine of 5 lakh rupees or both), section 66C(which prescribes penalties for identity theft and states that anyone who fraudulently or dishonestly uses a person’s identity information will be subject to imprisonment up to 3 years and a fine of up to 3 lakh rupees) and Section 66D (punishment for fraud by impersonation using computer resources) under of the Information Technology Act(IT) Act 2000.

If you find the above article useful, you can share the above poster image with your friends and family on social media.

Useless info as there is no option to lodge complaint for a misuse of PAN Card on Cybercrime.gov.in website complaint lodging menu.

There is no subcategory for PAN CARD Farud / Pan Card misuse.

Sandeep,

You have to register it under “other cyber crime”, there are so many different types of cybercrimes, they may not create categories for each of them. Also other remedies include filing a report in incometax.gov.in website which can be helpful while facing any IT notices on transactions done by misuse of your pan card. you need take legal recourse against organisations responsible for misuse of pan card.

regards,

satish