Chinese Loan App frauds – Beware of them

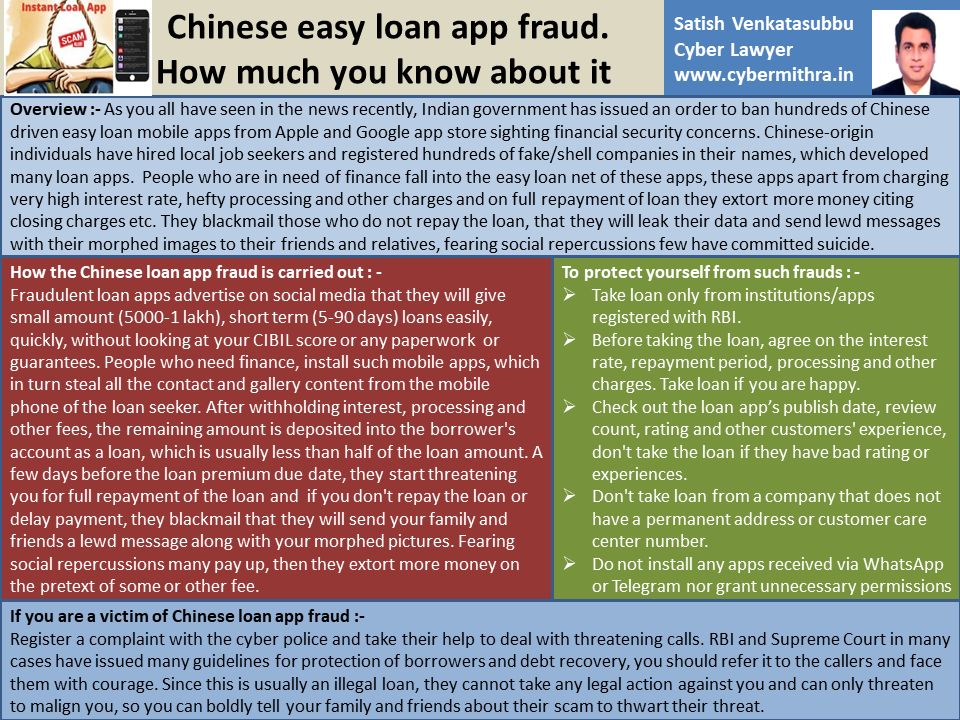

As you all have seen in the news recently, the Indian government has issued an order to ban hundreds of Chinese driven easy loan mobile apps from Apple and Google app store sighting financial security concerns. In last three years, Chinese-origin individuals have hired local job seekers and registered hundreds of fake/shell companies in their names, which developed many loan apps including Cash Master, Apna Paisa etc. People who are in need of finance fall into the easy loan net of these apps when they can’t get a loan anywhere.

Apart from charging them high interest rate (up to 300% per annum), hefty processing and other charges and on payment of complete loan they extort more money in lue of closing chares etc. They blackmail and threaten those who do not repay the loan, that they will leak their data and send lewd messages with their morphed images to their friends and relatives, fearing social repercussions few have committed suicide.

How Chinese Loan App fraud is carried out :-

Fraudulent loan apps advertise on social media that they will give small amount (5000-1 lakh) short term (5-30 days) loans easily, quickly, without looking at your CIBIL score, without paperwork and any guarantees. People who need finance, install such mobile apps, which in turn steal all the contact and gallery content from the mobile phone of the loan seeker. After withholding interest, processing and other fees, the remaining amount is deposited into the borrower’s account as a loan, which is usually less than half of the loan amount. A few days before the loan premium due date, they start threatening you for full repayment of the loan that if you don’t repay the money, they will send to your family and friends a lewd message along with your morphed pictures. Fearing social repercussions even if you payup the loan, they extort more money on the pretext of some or other fee.

To protect yourself from Chinese Loan App frauds :-

- Take loan only from institutions/apps registered with RBI.

- Before taking the loan, agree on the interest rate, repayment period, processing and other charges.

- Check out the loan app’s publish date, review count, rating and other customers’ experience, don’t take the loan if they have bad rating or experiences.

- Don’t take loan from a company that does not have a permanent address or customer care center number.

- Do not install any apps received via WhatsApp or Telegram.

- Generally loan apps or organizations do not ask for access permission to your private information like contact number and gallery, stay away from such organization/app which mandates it.

If you are a victim of Chinese Loan App fraud :-

Register a complaint with the cyber police and take their help to deal with threatening calls. RBI and Supreme Court in many cases have issued many guidelines for protection of borrowers and on process to be followed for debt recovery, you should refer it to the callers and face them with courage. Since this is usually an illegal loan, they cannot take any legal action against you and can only threaten to malign you, so you can boldly tell your family and friends about their scam to thwart their threat. The borrower can post a strong feedback on the app in playstore, can also send the same to google helpdesk email id. The borrower can also file a complaint with RBI at https://sachet.rbi.org.in/

Remedies available to borrower legally :-

- The borrower can ask them to file a civil case to recover dues and cite the below leading case: Manager, ICICI Bank Ltd. vs Prakash Kaur [Criminal Appeal No. 267 of 2007] – Supreme Court on 26th February, 2007, a two Judges Bench in Manager, held that Banks “should resort to procedure recognized by law to take possession of vehicles in cases where the borrower may have committed default in payment of the instalments instead of taking resort to strong arm tactics.” Deprecating the practice of hiring recovery agents, who are musclemen”, the Bench said such practice “needs to be discouraged”.

- The borrower can also file a police complaint under sections 419/420/385 Indian Penal Code(IPC) & 66 C, 66 D of IT Act

References :-

1. https://www.businessinsider.in/india/news/rbi-tightens-norms-for-chinese-lending-apps/articleshow/93629917.cms – RBI guidelines on lending

2. https://indiankanoon.org/doc/819703/ – Manager, ICICI Bank Ltd. vs Prakash Kaur

3. https://sachet.rbi.org.in/ – RBI portal on grievance redressal for borrowers.